Marlin Credit has been offering bridging finance since 2000. We pride ourselves in assisting clients with property bridging advances in a respectful and dignified manner at all times. Each client matters on a personal and professional level.

Our application process is streamlined and simple to ensure efficient and speedy processing and approval. We can advance up to 80% of the net proceeds and commit ourselves to a 4-hour turnaround time for approval, subject to the transaction requirements being met and the required documents and information being submitted for processing by the transferring / conveyancing attorney.

The conveyancing process to register the property to the new owner and for the seller to receive his property sale proceeds can take anything from 6 to 12 weeks. Many sellers need funds beforehand for Rates & Taxes, Compliance Certificates, paying a deposit on a new property, for personal use, etc.

Marlin Credit can advance a portion of your property sale proceeds to you if you are selling your property, which include vacant stands, houses, commercial property, etc. No building loans, property developments, etc.

The process of buying a property with an approved bond or buying a property through the sale of another property you have, is usually dependent on the registration of the

bond or the registration of the sale of your previous property. Typically the payment of transfer duty and costs or other relevant costs, have to be paid upfront to the conveyancer but the funds will only become available upon registration

Marlin Credit can advance a portion of your approved bond or the proceeds of a prior sale to buy another property (subject to the finance/proceeds exceeds the purchase price).

Switching your bond? Looking for a second?

The process to access funds from a further bond, 2nd bond or a bond switch typically takes 30 days. You might need funds for personal use.

Marlin Credit can advance a portion of this prior to registration.

The process to receive Estate Agent Commission is dependent on the registration of the property to the new owner.

Marlin Credit can advance a portion of agent commission upfront before registration of the sale.

Apply Here or contact to our support team.

Marlin Credit charges interest and fees as prescribed by the National Credit Act and regulated by the National Credit Regulator.

MARLIN CREDIT PTY (LTD): NCRCP327

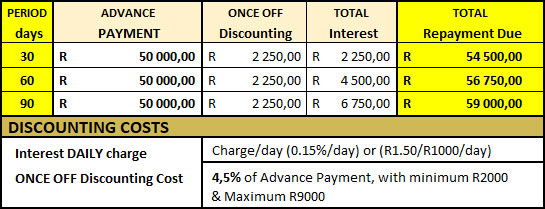

Example 1: R 50 000.00 Advance Payment

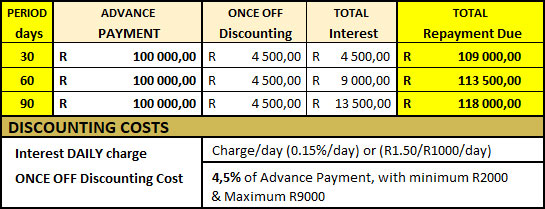

Example 2: R 100 000.00 Advance Payment

'Once Off' does not imply that payment is charged/due immediately.

Once Off discounting cost/fee is charged only once, no interest is charged on this. This is repaid along with the bridging advance amount PLUS the total daily interest @ registration by the transferring/bond attorney.

**NOTE THAT WE WILL NEVER CHANGE OUR ACCOUNT DETAILS VIA TELEPHONE, E-MAIL OR ANY OTHER ELECTRONIC FORM. PLEASE CONTACT THE WRITER FOR VERIFICATION SHOULD YOU RECEIVE ANY SUCH CORRESPONDENCE.**

General Terms & Conditions

Bridging Finance is granted against a lumpsum payout such as a pension or provident fund payout due to a client.

Bridging finance as per the above is subject to an affordability test.

The client signing a standard loan agreement.

Guarantee or alternatively life insurance signed.

The client accepting debi checks (debit order) for repayment of the loan.

The Interest rate is linked to prime.